Tokenization in Dubai Real Estate: The Future of Property Investment in the UAE

Tokenization in Dubai Real Estate

If you’ve been following the real estate buzz in Dubai, you’ve probably noticed that the conversation is shifting. We’re not just talking about skyscrapers, luxury villas, or waterfront penthouses anymore. Now, everyone’s talking about tokenization - a new way of buying and owning property that blends blockchain technology, fractional ownership, and even cryptocurrency payments.

It’s not some far-off concept; it’s already here, and Dubai is moving faster than most cities in the world to make it happen. Backed by the Dubai Land Department (DLD) and the Virtual Assets Regulatory Authority (VARA), tokenization is set to change the way properties are bought, sold, and managed in the UAE.

And if you’re wondering how it works - or whether it’s worth paying attention to - let’s break it down.

What Exactly Is Real Estate Tokenization?F

Think about how you buy shares in a company. You don’t have to own the entire business; you can own just a part of it, and your shares represent your ownership stake. Real estate tokenization works in the same way, but instead of shares, you get digital tokens that represent part of a physical property.

The difference is that everything happens on the blockchain, which means it’s transparent, secure, and (once the process starts) much faster than the old paperwork-heavy transactions.

How Tokenization Works in Dubai?

In Dubai, tokenization isn’t just a tech experiment; it’s carefully regulated. Here’s the journey in plain language:

- A property is chosen: usually a high-value or investment-friendly property.

- It’s prepared for tokenization: this includes legal checks, regulatory approvals, and a review of all documents.

- The property is split into tokens: each token represents a fixed fraction of the asset.

- Smart contracts are created: these are blockchain-based agreements that automatically manage transactions, ownership transfers, and even rental distributions.

- The tokens go live on a regulated exchange: investors can buy or sell them without needing months of negotiation or piles of paperwork.

It’s important to note that Dubai doesn’t allow just anyone to do this. The VARA requires companies to have proper licenses, capital reserves, regular audits, and even a published whitepaper outlining how the tokenization will work.

Why Dubai Is Leading the Charge?

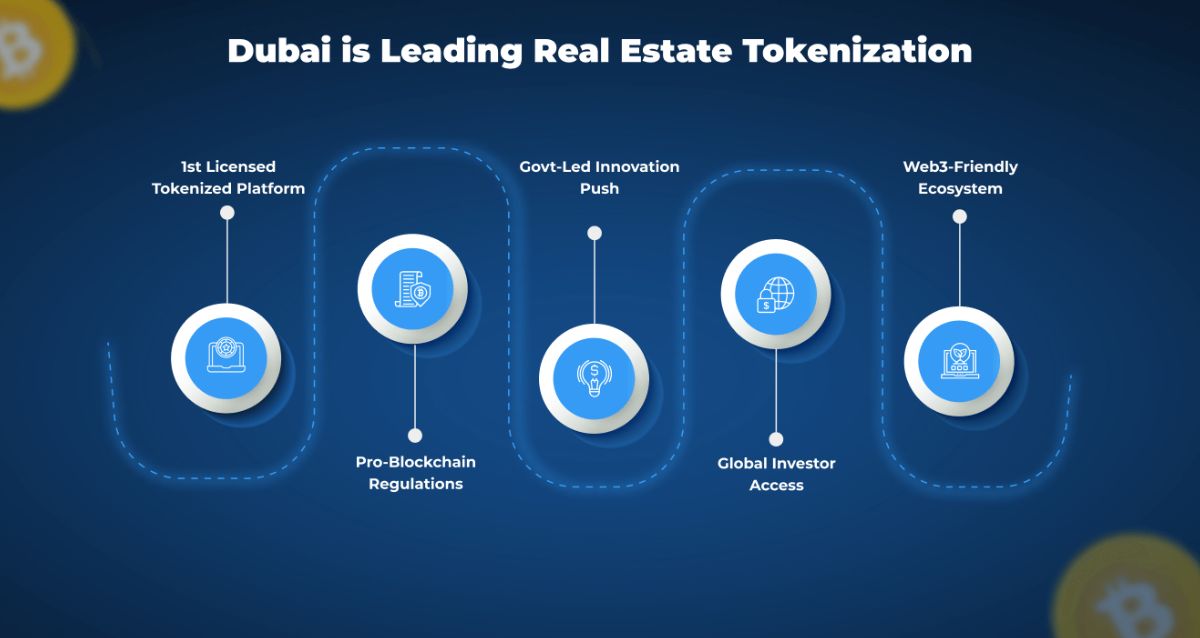

Dubai has been talking about becoming a tech-forward global city for years, and tokenization is a big part of that vision. The government isn’t just adapting to new trends; it’s shaping them.

The Dubai Economic Agenda D33 and the Dubai Real Estate Sector Strategy 2033 both emphasise digital transformation and making property ownership easier for people from all over the world. Tokenization fits right into that plan by breaking down barriers that used to keep smaller investors out of high-value real estate deals.

In the past, you needed huge upfront capital to own a piece of prime Dubai property. Now, thanks to fractional ownership, you can start with much smaller amounts and still be part of the game.

The Role of VARA and DLD in Tokenization?

If you’re going to invest in tokenized property, you want to know that the rules are clear and your rights are protected. That’s where VARA (Virtual Assets Regulatory Authority) and the Dubai Land Department step in.

VARA introduced a special category called Asset Referenced Virtual Assets (ARVAs), which is designed specifically for tokenizing real-world assets like real estate. This framework:

Allows tokenized properties to be traded on regulated exchanges or through licensed brokers.

Ensures that investors’ funds and rights are secure.

Keeps everything in line with Dubai’s existing property laws.

The DLD, on the other hand, has partnered with VARA, the Dubai Future Foundation, and the Central Bank of the UAE to launch projects under the Real Estate Evolution Space (REES) initiative. This makes the DLD the first real estate registration authority in the Middle East to embrace blockchain-based tokenization.

Benefits of Real Estate Tokenization in Dubai

Let’s talk about why this is such a big deal, not just for the UAE but for global investors.

1. Fractional Ownership

You no longer need to buy an entire property to be an owner. You can invest based on your budget and still get exposure to Dubai’s lucrative real estate market.

2. Greater Liquidity

In traditional real estate, selling your investment can take months. With tokenization, you can sell your tokens on the secondary market in days - sometimes even hours.

3. Blockchain Security

Every transaction is recorded on a decentralised ledger. It’s transparent, immutable, and highly secure.

4. Global Access

You could be sitting in London, Mumbai, or Singapore and still invest in a Dubai property without ever setting foot in the UAE.

5. Faster Transactions

With smart contracts, much of the process is automated. This means less paperwork and quicker ownership transfers.

Cryptocurrency Meets Real Estate in Dubai

One of the most exciting parts of tokenization is that you can buy property using cryptocurrency. Bitcoin, Ethereum, and USDT are already being accepted by some developers in Dubai.

This is huge for global investors because it removes foreign exchange barriers and makes cross-border property investment much simpler. Imagine sending crypto from your wallet and owning a piece of a Dubai Marina apartment within minutes. That's the future we’re talking about.

Who Can Participate in Tokenized Real Estate?

The tokenized property market in Dubai is open to:

- Individual Investors: Wanting fractional ownership opportunities.

- Institutional Investors & Real Estate Funds: Diversifying portfolios with blockchain assets.

- Developers: Offering tokenized projects to attract global buyers.

- PropTech & FinTech Startups: Building platforms for tokenized transactions.

- Virtual Asset Firms: Operating within Dubai’s regulated crypto framework.

- International Buyers: Entering the Dubai market without the usual barriers.

The Bigger Picture: Why This Matters for Dubai

Tokenization isn’t just about making real estate investment easier-it’s also about strengthening Dubai’s position as a global financial and innovation hub.

By introducing clear regulations, encouraging technology adoption and opening the market to smaller investors, Dubai is building a property ecosystem that’s more inclusive, transparent, and future-ready.

It’s also worth noting that tokenization could encourage more sustainable property development. Developers can raise funds more efficiently through token sales, while investors get access to projects earlier in the development cycle.

Final Thoughts

We’re at the start of something big. Dubai real estate tokenization is more than just a buzzword - it’s a shift in how property investment works. For investors, it means more options, lower entry costs and the ability to diversify like never before. For Dubai, it means attracting global capital, tech innovators and a new generation of property owners.

If you’ve ever thought about investing in Dubai real estate but felt it was out of reach, tokenization might be your ticket in. Just make sure you’re working with VARA-licensed platforms and understand the risks before jumping in.

Because one thing is clear: the future of Dubai real estate is digital, and it’s happening right now.